The Financial Sector’s Bullish Comeback: Is It Time to Start Looking at Bank Stocks?

One effective way to spot potential market opportunities on a sector level is to regularly monitor Bullish Percent Index (BPI) readings for each sector. Sector-focused BPIs tell you the percentage of stocks generating Point & Figure Buy Signals. From that point on, you can drill down to specific industries to find ETFs or stocks presenting tradable opportunities.

One effective way to spot potential market opportunities on a sector level is to regularly monitor Bullish Percent Index (BPI) readings for each sector. Sector-focused BPIs tell you the percentage of stocks generating Point & Figure Buy Signals. From that point on, you can drill down to specific industries to find ETFs or stocks presenting tradable opportunities.

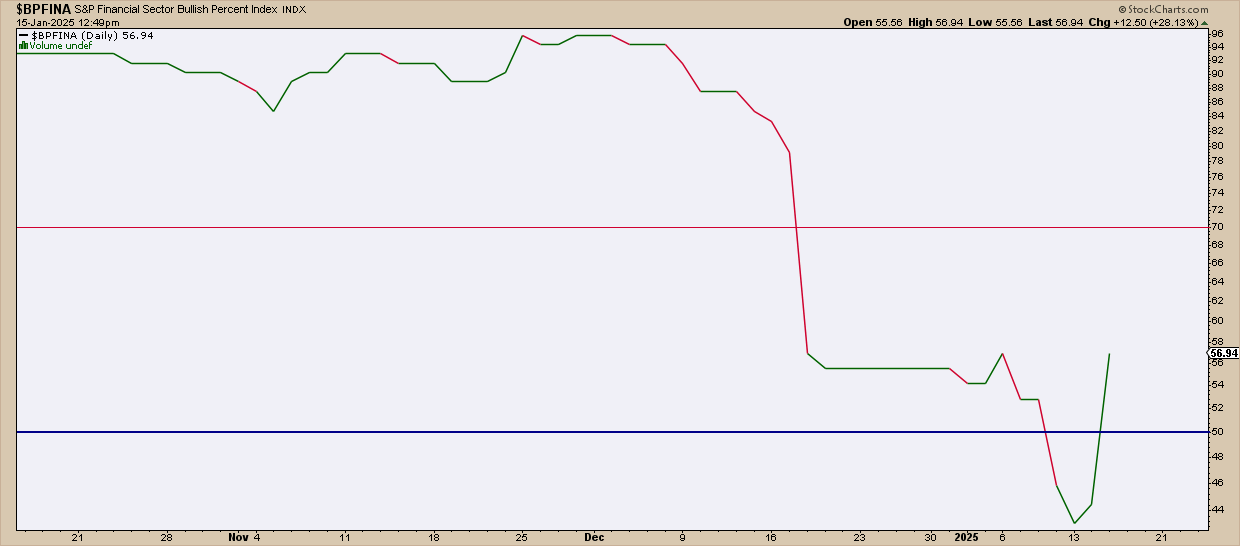

On Wednesday morning, following an encouraging CPI report and a strong kick-off to quarterly bank earnings, the BPI for the financial sector ($BPFINA) dramatically rose.

FIGURE 1. BPI FOR FINANCIAL SECTOR ($BPFINA). After a selloff, 56% of stocks in the financial sector triggered P&F buy signals.Chart source: StockCharts.com. For educational purposes.

After hovering above the 70% line for months, a threshold that signals potential overbought conditions, $BPFINA declined in December, falling short of touching the "oversold" threshold of 30%. On Wednesday, it jumped above 50%, a line that favors the bulls as it indicates that over 50% of stocks within the sector are generating P&F buy signals.

In addition to a tempered CPI report, one which followed a similar PPI reading from the previous day, strong bank earnings were a key driver behind Wednesday's dramatic market rally, particularly the big players: JPMorgan Chase (JPM), Goldman Sachs (GS), Wells Fargo (WFC), and Citigroup (C).

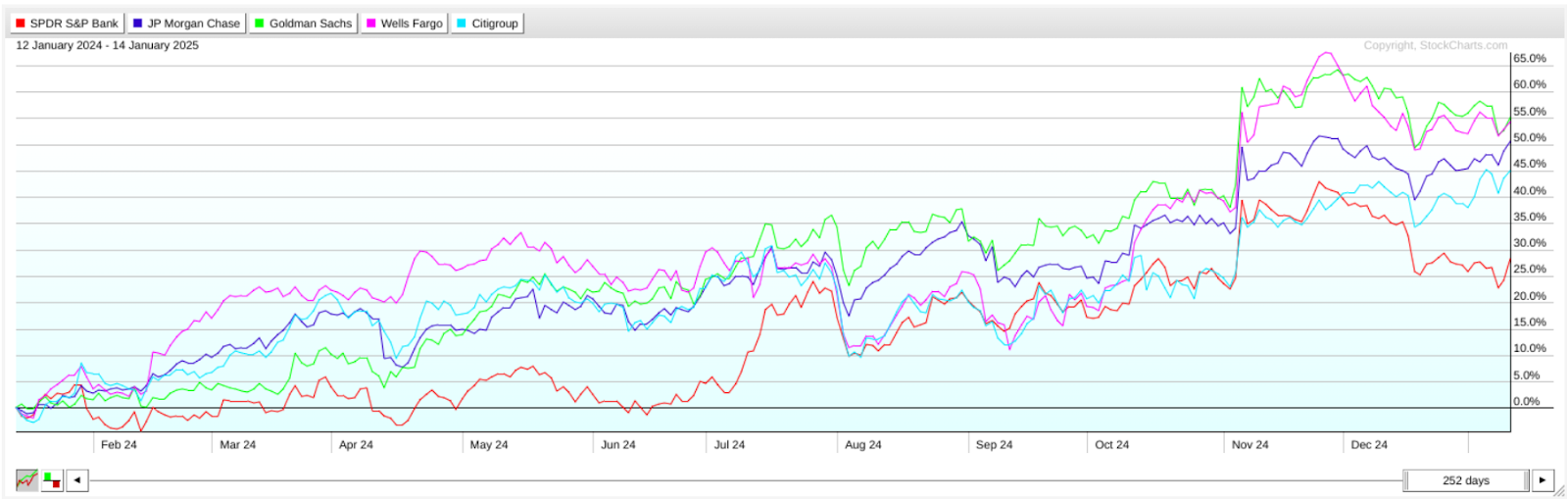

Let's use PerfCharts to compare the SPDR S&P Bank ETF (KBE), our bank industry proxy, to these four names. KBE provides an equal-weighted representation of small-, mid-, and large-cap bank stocks, giving a wider context to view relative performance.

FIGURE 2. PERFCHARTS OF KBE, JPM, GS, WFC, AND C. Note that all four banks are outperforming KBE.Chart source: StockCharts.com. For educational purposes.

This quick view tells you that in the last year, the "big four" have been outperforming the broader banking industry. Wells Fargo and Goldman Sachs are leading the pack, followed by JPMorgan Chase and Citigroup.

Suppose, however, you wanted to take a diversified position by going long KBE, anticipating the possibility that the banking industry might see a favorable year, especially under the new White House administration. Take a look at a daily chart of KBE.

FIGURE 3. DAILY CHART OF KBE. After losing bullish momentum, KBE is at a juncture that is neither definitively bullish nor bearish. Chart source: StockCharts.com. For educational purposes.

Here are a few key observations about the chart:

- The ZigZag line clearly shows the swing points identifying when the uptrend and near-term downtrend were broken (remember, uptrend = HH and HL, and the opposite is true of a downtrend).

- The orange circles highlight the nearest swing low and high points, both of which were breached, making the near-term uptrend or downtrend uncertain at this time.

- For the downtrend to resume, KBE would have to fall below $53, the November low (see blue dotted line) that served as support.

- For a new uptrend to take place, KBE must stay above $53 and eventually break above potential resistance at $58 (see red dotted line) before challenging the two November highs.

In short, it's a wait-and-see moment. If you entered early, a stop-loss below $53 or any of the consecutive swing low points (see ZigZag) can be helpful.

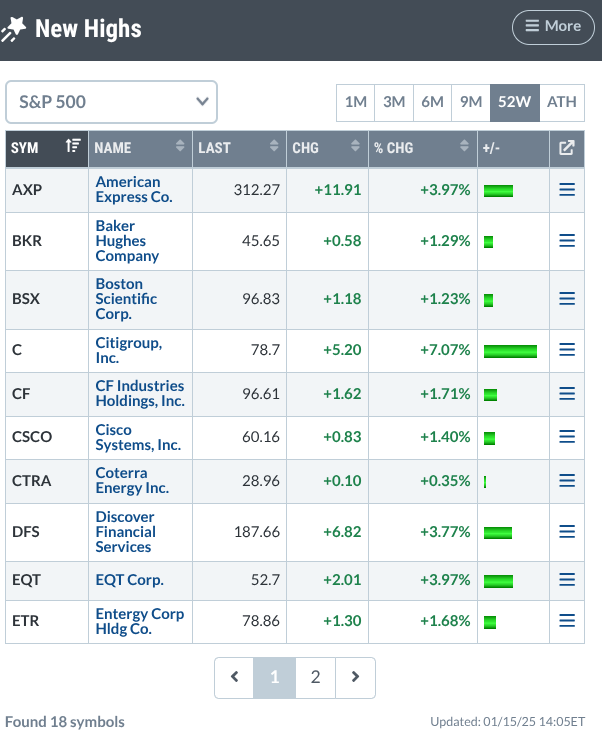

If you're considering investing in individual banking stocks, among the four big banks reporting outstanding earnings results, Citigroup made a new 52-week high. I identified this using the StockCharts New Highs Dashboard panel.

FIGURE 4. NEW HIGHS TOOL. Citigroup made a new 52-week high on Wednesday morning and is worth a closer look.

Let's take a closer look. Below is a daily chart of Citigroup.

FIGURE 5. DAILY CHART OF CITIGROUP. A steady uptrend culminating in a bullish yet parabolic jump.Chart source: StockCharts.com. For educational purposes.

A couple of main points:

- Citigroup saw a tremendous jump Wednesday as its Q4 earnings beat Wall Street's expectations; analysts' fundamental targets have been revised to as high as $102, with $80 as the median price target.

- The Relative Strength Index (RSI) barely entered overbought territory (see orange circle), indicating strong momentum.

- The Accumulation/Distribution Line (ADL) is recovering after a prolonged drop in money flows.

- The On Balance Volume (OBV) shows significant buying pressure.

As Citigroup makes new highs, its parabolic move may be countered by a slight pullback. If so, the scenario is straightforward. If you look at the ZigZag lines and the support levels of the two most recent swing lows (see dotted blue lines), you can identify the prices that, if broken, could call the stock's uptrend into question.

These levels, both of which should serve as support, are especially critical for any trader who has opened a long position. Also, monitor the $74 range that coincides with the last two consecutive swing high points. While these highs are near the current price, they could still act as a support level if the stock pulls back.

If you're looking to enter a position, it may be wise to wait and observe how the price reacts to any of the support levels before deciding to go long. If the price falls below these levels, additional support could emerge at subsequent swing lows. However, in the case of a significant reversal, you would need to reassess the trend to determine whether support levels represent buying opportunities or merely temporary rally points in a bearish trend.

At the Close

Financials are showing signs of recovery and renewed momentum, with $BPFINA crossing a key bullish threshold. Strong bank earnings are driving market sentiment, with Citigroup making a new 52-week high.

What to do: Add Citigroup to your ChartLists. Use a basic support and resistance perspective to guide your decisions and watch the swing points to determine the status of the trend.

Disclaimer: This blog is for educational purposes only and should not be construed as financial advice. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional.